Cross Triparty Optimization

Optimize seamlessly across fragmented triparty agents to drive firm-specific economic benefits

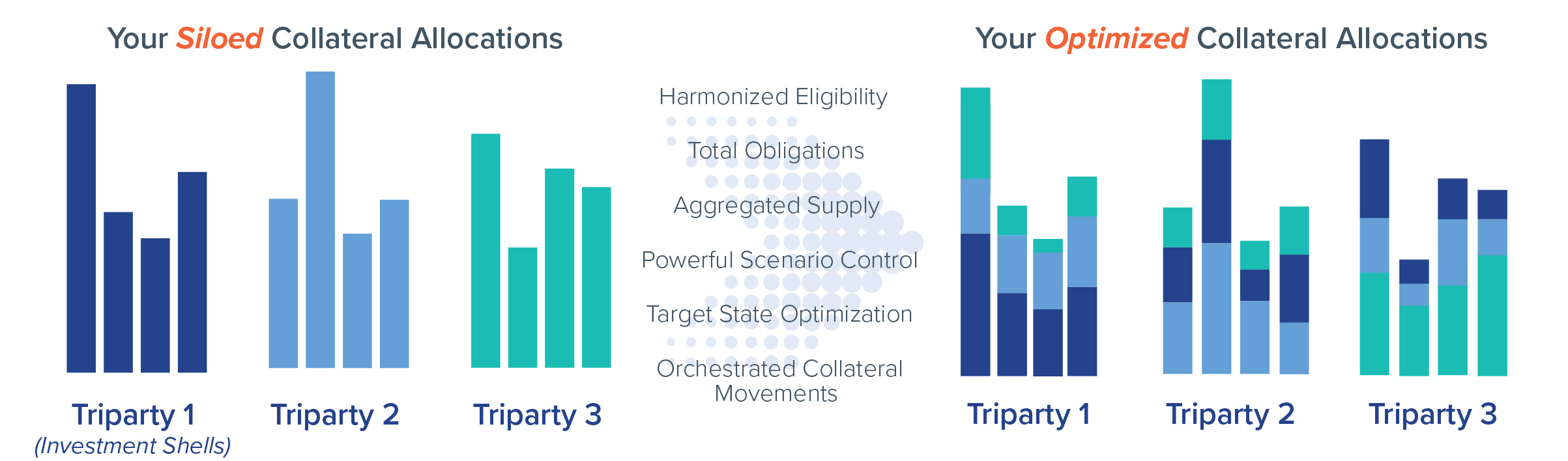

Triparty agents can only optimize based on limited information they can see and as a result most firms operate with significant inefficiencies driven by fragmented triparty agents setup across regions and business lines.

Transcend’s Cross Triparty Optimization unifies obligations, collateral, eligibility, and business constraints across a growing network of triparty agents. Our clients now have the ability to simultaneously solve for multiple binding constraints including liquidity, funding, capital, or operational costs to produce an ideal collateral allocation across all their triparty obligations. With automated decision-making feeding a robust Booking Service to mobilize the collateral to the exact deal shell, Transcend clients truly achieve end-to-end target state optimization… maximizing financial results and reducing operational friction.

Discover the Key Features of Cross Triparty Optimization

- Out-of-the-box connectivity to global triparty custodians

- If market conditions or internal policies change easily updated your optimization strategy to incorporate these new conditions

- Easily solve for multiple binding constraints at the same time in one place

- Automatically allocate collateral to the deal/shell level with precision

- View harmonized eligibility, positions, deals and allocations

- Run “what-if” scenarios to help plan and forecast for changes in your business mix

The Benefits of Cross Triparty Optimization

- Reduce unsecured funding usage, maximize liquidity and capital and more

- See and evaluate eligibility in real time for better risk assessment and negotiations

- Factor operational costs into decision making to reduce manual or unnecessary mid and back-office processes

- Partner with Transcend for specialized data management and processing to accelerate your strategy vs other build or buy alternatives

- Systematically preposition collateral to the best box locations

- Easily scale our solution either across business, regions or other obligation types such as CCPs or OTC derivatives

- Allocate securities to the exact deal shell to achieve maximum collateral value

Let’s Talk About How Cross Triparty Optimization Can Elevate Your Funding & Liquidity Efficiencies

Global Investment Bank Saves Millions in Collateral Costs by Optimizing Across Triparty Agents

With collateral costs increasing, the equity finance team at a global investment bank needed to understand to what extent elevated triparty decisions and automation would drive better financial and operations results.

Transcend worked with our client to design a proof of concept, confirming that automating inventory optimization would lead to more efficient collateral outcomes, improved and financial results and, annually saving millions of dollars.

Client Success Story

Uncleared Margin Optimization

Uncleared Margin Optimization

Realize the Impact of Holistic Margin Optimization Technology

With regulations such as the Uncleared Margin Rules (UMR) increasing the scope and complexity of posting collateral as margin for OTC derivatives, technology is needed to automate smarter collateral decisions.

With intraday insight into cross-business uncleared margin requirements, Transcend evaluates the margin calls against eligible inventory, running sophisticated scenarios to select the most economically and operationally efficient collateral to pledge. As a result, Transcend not only helps clients select eligible collateral, but more so Transcend helps clients select the most economically efficient collateral, resulting in millions in cost savings every year. With an integrated Booking Service, Transcend automatically executes thousands of collateral allocations in minutes to help its clients achieve critical STP.

A New Paradigm for Uncleared Margin Optimization

Transcend offers the industry’s most sophisticated optimization technology, helping its clients achieve unparalleled performance improvements

Leading the Industry in Uncleared Margin Optimization

With demonstrated successes for the world’s leading banks, broker-dealers, custodians, and asset managers, Transcend has solved even the most complex data, infrastructure, and implementation challenges in order to deliver transformational results.

With typical deployments completed in months, achieving best-in-class, scalable optimization is within reach.

Solution Highlights Include:

- Direct Integrations With Derivatives Margin Systems

- Digitization of Legal Agreements and Collateral Schedule Terms

- Ability to Apply Dynamic Costs and Constraints to Multiple Optimization Scenarios

- Integrated Booking Service for Execution Automation and Straight-through-Processing

- Custom or Turn-key Optimization Algorithms

- Real-time Insights Into Margin Call Statuses, Disputes, and Fails

Ready to Centralize and Optimize Margin Management?

Banks and Broker Dealers

Banks and Broker Dealers

Transparency and Efficiency Has Never Been More Important

Transcend’s fully integrated solution suite empowers clients to pick and choose the capabilities needed to fill In current gaps and limitations.

Powering Decisions Across the Firm

Transcend harmonizes historically disconnected data points across the enterprise, giving teams a single, golden source of liquidity, funding, and inventory information. With powerful analytics, optimization, and automation capabilities, clients realize financial and operational efficiencies while minimizing risk exposure.

Solutions Designed For:

- Securities Finance

- Funding

- Treasury

- Operations

- Derivatives

- FCMs

- Prime Services

- Risk and Regulatory

Ready to Elevate Your Funding, Liquidity, and Inventory Decisions?

Securities Finance

Securities Finance

An End-to-End Intelligence Solution

Explore our full suite of securities finance solutions to augment the impact of repo and lending activities.

Extract the Greatest Value From Financing Activities

Connect data spread across trading and collateral management systems to deliver more powerful insights and optimized STP

Achieve Complete Transparency, Optimal Allocations, and Automated Execution

Optimize global fixed income, equities, and cash

The securities finance ecosystem is incredibly bifurcated and siloed across functions, teams, products and technology. Without a single platform to harmonize, monitor and automate repo and securities lending activities, individual and firm-wide performance is limited.

Transcend integrates with your internal trading and collateral management systems in addition to your CCP, triparty and third-party relationships to create a single, golden source of your securities financing activity. With a full suite of products, Transcend identifies more efficient financial and human capital usage and empowers smarter decisions across the front-, middle- and back-office.

Key Benefits:

- Connect firm-wide assets and liabilities to optimally deploy global inventory

- Gain top-down control over collateral to increase liquidity and improve return on capital

- Gain tailor-made allocation recommendations with flexible configuration of specific resource costs

- Dynamically adapt to changing regulatory demands and business priorities

- Achieve automation and STP for both front- and back-office functions

Want To Learn How Much Your Business Could Save In Efficiencies?

Integration Service

Integration Service

Seamlessly Connect Your Capital Markets Ecosystem

Eliminate a reliance on internal development resources to maintain complex infrastructure integrations

Transcend works tirelessly to build the industry’s most comprehensive network of out-of-the-box connectivity. With deep industry relationships across capital markets service providers, technology vendors, custodians, exchanges and CCPs, all of our solutions are built to seamlessly integrate with your existing capital markets infrastructure.

Leverage our Integration Service through the implementation of any of our products, or leverage our standalone connectivity products to power your internal capabilities.

Learn More

Triparty Link

Out-of-the-Box connectivity to global Triparty custodians

Transcend’s pre-established integrations with Triparty Agents help clients achieve cross-Triparty collateral management. Connect Triparty Link to your internal optimization solution or leverage our industry-leading Triparty Optimization Engine!

CCP Link

Out-of-the-box connectivity to global central clearing counterparties & exchanges

Utilize out-of-the-box API connections with Transcend’s global CCP network to automatically standardize and aggregate CCP and exchange data in real-time. Insert our modular integration components into your internal systems, or leverage our CCP Margin Workflow & Optimization Solution, CCP Central to elevate your overall CCP strategy.

Technology Connectivity

Transcend is vendor-agnostic, meaning that we can integrate our solutions with any of your existing technology systems. Having served some of the industry’s largest and most complex market participants, Transcend has already established integrations with dozens of industry-leading technology systems. If you are a technology provider who is interested in partnering with Transcend, click here to get in touch.

Explore Some of our Formal Integration Partnerships

Eligibility Link

Utilize multiple APIs to integrate agreement schedules and terms across triparty agreements, (G)MSLA, (G)RMA, ISDA CSA, and global CCP terms. With a digital connections to all firm wide eligibility schedules, Transcend empowers firms to fuel internal optimization and STP initiatives. Check out our Eligibility Central solution and see how Eligibility Link is bundled with powerful analytics capabilities that can identify new funding opportunities.

Interested in Learning More About our Integration Service?

Enterprise Margin Intelligence

Unlock Cross-business Margin Transparency

Improve risk management with real-time visibility into the status of margin calls, disputes, and fails across all counterparty activity

With collateralized businesses becoming increasingly siloed, many firms leverage multiple systems to manage margin requirements for OTC Derivatives, Futures & Cleared Derivatives, Repo, TBAs, and Securities Lending. This leads to disjointed processes that can complicate risk and exposure management.

Transcend’s Margin Intelligence solution harmonizes business-specific margin workflow solutions to create a single view of margin activity. This enables firms to be more coordinated in managing exposure risk by running holistic exposure analysis across businesses.

Unleash Enhanced Decision Making and STP

Integrate Transcend’s Optimization and Booking Service capabilities

With a centralized margin activity center, Transcend sets clients up for seamless optimization and booking execution. Connect Margin Intelligence with Transcend’s Collateral Optimization capabilities to identify the most efficient assets to post as margin. Add on the Booking Service and allocate eligible collateral as margin regardless of system/custodian, margin type, region, business line or legal entity.

Additional Benefits of Centralized Margin Intelligence Includes:

- Reduce time, cost, and risk by transferring collateral directly from a single dashboard

- Seamlessly meet regulatory demands and manage the growing volumes of daily and intraday margin

- Effectively manage complex margin call demands while minimizing overhead and risk

- Increase controls with exposure management within business-lines and across the enterprise

Ready to More Effectively Run Margin Management Across the Enterprise?

QFC Recordkeeping

QFC Recordkeeping

Increase Reporting Accuracy and Efficiency

U.S. domiciled financial companies deemed in-scope for compliance with Qualified Financial Contract (QFCs) Recordkeeping and Reporting must generate a daily report for linking governing agreements and other related information for each reportable QFC position. However, creating these reports can be a massive, time consuming burden given the complexity of and disparity between positions, collateral, agreements, and guarantees.

Transcend has enabled firms to seamlessly meet QFC Recordkeeping requirements by capturing, harmonizing, and linking all required positions, collateral, agreements, and reference data for in-scope products. With independent validation of reports against the latest specifications, Transcend ensures that reports submitted via the system are accurate.

QFC Recordkeeping Resources

Ready to Simplify Your QFC Recordkeeping Process?

ESG Solutions

ESG Solutions

ESG Analytics, Optimization, and Automation

Select the ESG solutions that matter most to your firm

Meet emerging ESG collateral management and financing requirements with scale

As beneficial owners provide stricter collateral guidelines in line with their ESG policies, agent lenders and the broader collateralized markets are considering how to best incorporate ESG criteria into existing workflows. However, without definitive guidance around preferred ESG data providers and metrics, firms require a flexible and scalable solution. Transcend empowers market participants to seamlessly fold ESG requirements into existing collateral flows & analytics.

Unparalleled Flexibility

Integrate your preferred ESG data providers

Transcend’s ESG Solutions ingest reference data from your preferred ESG data provider in various formats to ensure you can meet the disparate requirements of clients and counterparties today, while delivering scalability as best practices evolve in the future.

Transcend’s ESG Solutions Help Clients:

- Flexibly ingest and tag inventory with ESG performance metrics from your preferred data provider for granular ESG portfolio analytics

- Run validation analytics to ensure that collateral received is in line with a client’s ESG expectations

- Incorporate ESG criteria and constraints into Transcend’s optimization engine to book the smartest collateral allocations that meet ESG requirements

ESG News & Resources

Ready to Get Ahead of ESG Collateral Challenges?

Inventory Intelligence

Inventory Intelligence

Real-time Insights Into Actual and Projected Inventory

Enable coordinated funding, collateral allocation, and trading decisions

Inventory transparency is critical to making informed decisions; a holistic view of firm-wide inventory is needed to run transfer pricing, collateral optimization, and liquidity and risk management. Transcend Inventory Intelligence streamlines more powerful analytics, optimization, and mobilization capabilities for smarter funding, trading, and collateral management.

Key Benefits

- Build a cornerstone for optimized decision-making with rich details put in business context

- Inform analytics and optimization decisions with a real-time, integrated view of current and projected settlement positions

- Elevate collateral management with a real-time, connected view of all of your firm’s assets, obligations, and agreements

- Centralize access to all inventory positions and flows from a single platform

- Increase transparency and trace inventory positions to the specific trading activity that is driving flows

Notable Features

A Cut Above Traditional Inventory Management

Transcend Inventory Intelligence is your key to smarter allocation decisions

The structure of both sell-side and buy-side firms is becoming increasingly complex. With new products and investment strategies emerging and technology becoming more specialized, firms are becoming more siloed. These silos across teams, legal entities, accounts, and jurisdictions, make it very difficult to track financial resources across the firm, hiding strategic information while exposing new risks.

Transcend Inventory Intelligence harmonizes global assets across the firm in one place to provide insights into enterprise-wide inventory. With integrated sources and uses tagging, Transcend has launched traditional inventory management into the future, making sure clients can utilize assets most effectively.

Learn More

Ready to Take Your Inventory Management Capabilities to Next Level?

Booking Service

Inventory Intelligence

Achieve End-to-End Asset Mobilization

Automate complex workflows for single- or multi-step transactions

As collateral velocity continues to rise, operations teams are under pressure to implement scalable and controlled solutions for booking automation.

Transcend’s Booking Service provides a full stack of services to execute the movement of cash and collateral across triparty agents, CCPs, bilateral counterparties and internal systems. The solution integrates directly with either internal or street-facing technology systems to automate execution of one or thousands of transactions in minutes, regardless of complexity.

Transcend’s Booking Service Empowers its Clients to:

- Centralize access to global inventory positions and flows from a single platform

- Eliminate the friction of operationalizing collateral mobilization and optimization

- Reallocate attention formally spent selecting and executing bookings to more strategic initiatives

Integrate An Optimization Solution For Next-level Results

Connect Transcend’s Booking Service with an optimization engine to execute the best set of collateral instructions. Harness your own optimization capabilities or leverage Transcend’s sophisticated Inventory Optimization solution to unlock maximized economic and operational efficiency.

Ready to Take Your Inventory Management Capabilities to Next Level?

Transfer Pricing

Transfer Pricing Technology

Encourage Optimal Trading Decisions

Seamlessly improve business and firm-wide profitability

Transcend Transfer Pricing technology applies rules and rates to the sources and uses of enterprise-wide assets to help ensure business activity aligns with both business-specific and firm-wide policies. Seamlessly post pricing results as expenses to your firm’s books and records with timely, accurate, and auditable entries for historical analyses.

Additional Benefits of Transcend Transfer Pricing Include:

- Encourage smarter trading and funding decisions with insights into secured and unsecured funding and liquidity costs across the enterprise

- Ensure consistency and neutrality across the firm’s business lines by enforcing consistent funding policies

- Incentivize the best use of collateral and funding through consistent and transparent allocation of funding costs

- Eliminate internal arbitrage opportunities and achieve a better outcome for the firm by driving more informed pricing and trading decisions

- Accurately calculate Prime cost of carry using the client – debit balances and net funding requirements

Align Trading Activities with Business Goals

Seamlessly apply policies and allocate the costs of various trading and funding activities to incentivize more efficient trading behaviors

Effective Transfer Pricing is critical for firms to encourage trading and client behaviors that align with enterprise-wide funding goals, risk appetite, and policies. However, because legacy technology ecosystems are typically complex, and disjointed, market participants lack the transparency required to enforce ideal funding strategies. As a result, simplistic or even untimely cost-of-carry allocations can lead to bad business decisions or instances of internal arbitrage.

Transcend Transfer Pricing utilizes a rules-based allocation engine to apply the costs and benefits of both secured and unsecured financing activities back to each business, desk, and trader. As a result, clients are able to effectively encourage optimal business activity. With industry-leading implementations, Transcend helps clients realize improvements to P&L and client service in months.

Ready to Enforce Business-Aligned Trading Behaviors with Effective Transfer Pricing?

Sources and Uses

Inventory Intelligence

Build Your Sources and Uses Toolkit

Transcend offers the industry’s most comprehensive Sources and Uses framework. Select one or multiple of our Sources and Uses capabilities.

Real-time Insights Into Actual and Projected Inventory

Enable coordinated funding, collateral allocation, and trading decisions

Inventory transparency is critical to making informed decisions; a holistic view of firm-wide inventory is needed to run transfer pricing, collateral optimization, and liquidity and risk management. Transcend Inventory Intelligence streamlines more powerful analytics, optimization, and mobilization capabilities for smarter funding, trading, and collateral management.

Key Benefits

- Build a cornerstone for optimized decision-making with rich details put in business context

- Inform analytics and optimization decisions with a real-time, integrated view of current and projected settlement positions

- Elevate collateral management with a real-time, connected view of all of your firm’s assets, obligations, and agreements

- Centralize access to all inventory positions and flows from a single platform

- Increase transparency and trace inventory positions to the specific trading activity that is driving flows

Notable Features

Greater Intelligence. New Efficiencies. Superior Returns.

Connect the dots between the movement of your assets for better trading and allocation decisions

Regulatory changes and economic pressures are increasing the importance of analyzing the sources and uses of financial resources and understanding the broader impact to your firm. However, information regarding the origination of assets is typically disconnected from the utilization of those assets, making it incredibly difficult to make optimal trading and funding decisions.

Transcend has developed a rules-based allocation engine that empowers clients to ensure the optimal usage of their assets. With detailed insights into the sources of collateral and funding and how those resources are deployed, Transcend helps inform a broad scope of liquidity, trading, billing, and financing decisions. The results include greater efficiency, transparency, and performance across the enterprise.