Cross Triparty Optimization

Optimize seamlessly across fragmented triparty agents to drive firm-specific economic benefits

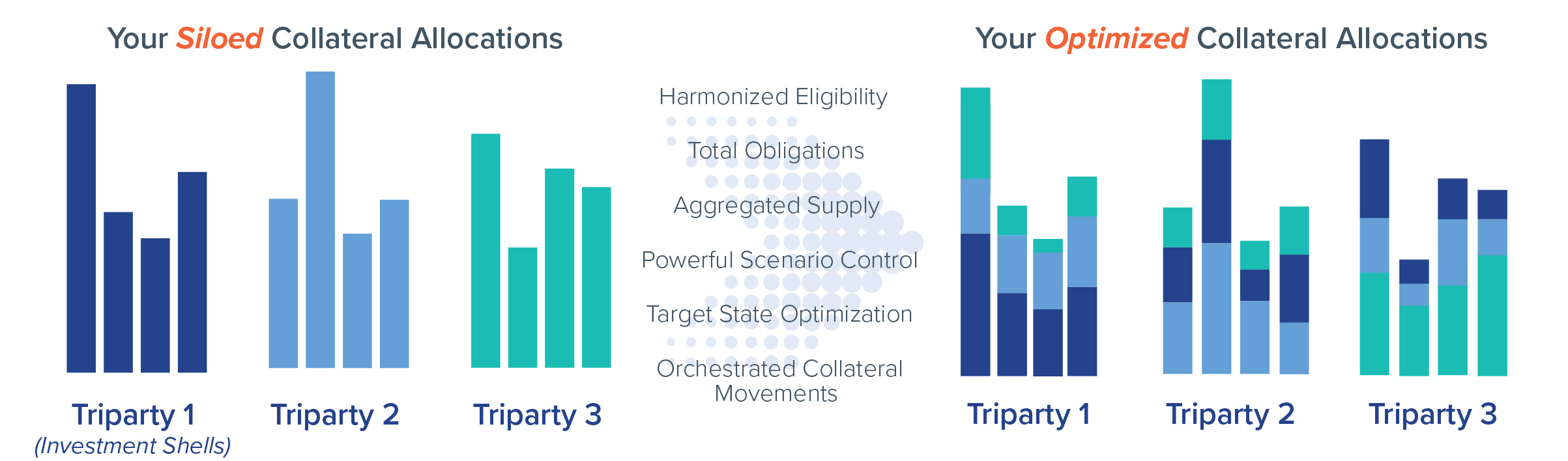

Triparty agents can only optimize based on limited information they can see and as a result most firms operate with significant inefficiencies driven by fragmented triparty agents setup across regions and business lines.

Transcend’s Cross Triparty Optimization unifies obligations, collateral, eligibility, and business constraints across a growing network of triparty agents. Our clients now have the ability to simultaneously solve for multiple binding constraints including liquidity, funding, capital, or operational costs to produce an ideal collateral allocation across all their triparty obligations. With automated decision-making feeding a robust Booking Service to mobilize the collateral to the exact deal shell, Transcend clients truly achieve end-to-end target state optimization… maximizing financial results and reducing operational friction.

Discover the Key Features of Cross Triparty Optimization

- Out-of-the-box connectivity to global triparty custodians

- If market conditions or internal policies change easily updated your optimization strategy to incorporate these new conditions

- Easily solve for multiple binding constraints at the same time in one place

- Automatically allocate collateral to the deal/shell level with precision

- View harmonized eligibility, positions, deals and allocations

- Run “what-if” scenarios to help plan and forecast for changes in your business mix

The Benefits of Cross Triparty Optimization

- Reduce unsecured funding usage, maximize liquidity and capital and more

- See and evaluate eligibility in real time for better risk assessment and negotiations

- Factor operational costs into decision making to reduce manual or unnecessary mid and back-office processes

- Partner with Transcend for specialized data management and processing to accelerate your strategy vs other build or buy alternatives

- Systematically preposition collateral to the best box locations

- Easily scale our solution either across business, regions or other obligation types such as CCPs or OTC derivatives

- Allocate securities to the exact deal shell to achieve maximum collateral value

Let’s Talk About How Cross Triparty Optimization Can Elevate Your Funding & Liquidity Efficiencies

Global Investment Bank Saves Millions in Collateral Costs by Optimizing Across Triparty Agents

With collateral costs increasing, the equity finance team at a global investment bank needed to understand to what extent elevated triparty decisions and automation would drive better financial and operations results.

Transcend worked with our client to design a proof of concept, confirming that automating inventory optimization would lead to more efficient collateral outcomes, improved and financial results and, annually saving millions of dollars.