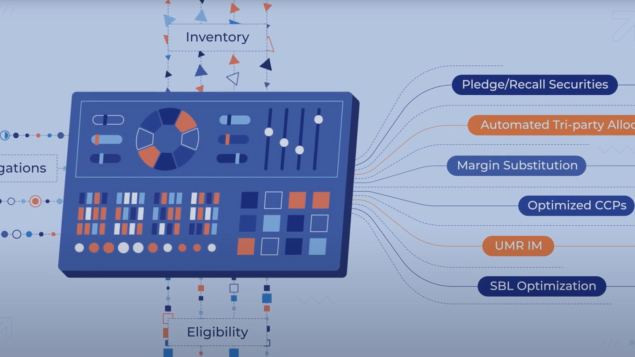

The Transcend Approach to Collateral Management

By connecting the dots between disparate eligibility, inventory, trading, cash, and counterparty data, Transcend reveals new opportunities and enables smarter decisions.

The Transcend

Difference

Transcend sits on top of your holistic collateral system suite to accelerate time-to-value and achieve peak performance results. Plus, it helps to have the industry’s greatest minds behind strategy, development, and customer service.