Cash & Liquidity Intelligence

Achieve Financial Efficiencies and Improve Risk Management

Strategically fund your business

With accurate transparency into historical, current, and projected cash balances and liquidity compositions, Transcend helps clients realize significant balance sheet improvements through smarter cash and liquidity management.

Additional Benefits

- Avoid and proactively cure cash deficits

- Prevent unnecessary draws from credit lines

- Limit the size of cash buffers in accounts

- Improve forecasting across funds / accounts

- Seamlessly comply with various liquidity guidelines, such as BCBS248

- Identify ideal funding scenarios based on business / client demands

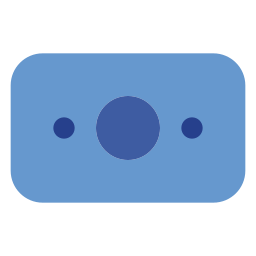

One Solution. Three Powerful Capabilities.

Transcend Cash and Liquidity Intelligence aggregates trades, positions, and cash balances across global accounts for transformational analytics and reporting.

Intraday Cash Flows & Liquidity Projections

Empower Treasury teams to improve financial performance through more efficient cash utilization and HQLA retention

With cash and securities spread across accounts with multiple custodians / paying agents, firms struggle to effectively manage liquidity and project cash balances in real-time. Without a single view of cash and securities, firms are inaccurately forecasting cash balances, inefficiently managing cash buffers, and leaving cash balances uninvested. This ultimately exposes these firms to liquidity risk while also creating a significant drag on performance.

By harmonizing cash and securities across depos, nostros, and internal accounts, Transcend empowers treasury and collateral management teams to make smarter intraday cash and liquidity decisions across the enterprise.

Learn More

Ready to Seamlessly Reduce Liquidity Risk while Improving Financial Performance?

Prime Intelligence

Prime Services Intelligence

Drive Smarter Practices for Trading, Financing, and Client Profitability

Surface key insights within your clients’ portfolios, their composition, and liquidity

Efficient use of collateral and funding combined with transparent, dynamic client pricing are key enablers for Prime Services teams to reduce costs, increase margins, and create profitable client relationships.

With a full suite of analytics capabilities, Transcend Prime Intelligence surfaces actionable insights required to optimally finance, hedge, and manage the business.

Key Benefits Include:

- Greater client profitability through active management of client scorecard

- Increased internalization both within the Prime Business and throughout the firm

- Lowered funding costs

- Improved utilization of hard-to-borrow securities

- More strategic client billing practices

Our Capabilities

Transcend Prime Intelligence offers an integrated suite of customizable analytics that empower the business with meaningful insights. Pick and choose the capabilities that matter most to your firm.

Ready To Boost The Performance Of Your Prime Business?

Collateral Validation

Collateral Validation

Holistic Collateral Validation Across All Collateralized Products

Streamline risk mitigation using holistic industry integrations

Transcend seamlessly connects with global triparty agents, CCPs, and margining systems to fully automate a holistic and comprehensive collateral validation and alert process.

With a single platform to analyze collateral received across counterparties, regions, and businesses, your firm has the transparency and efficiency required to more effectively manage liquidity, funding, and inventory risks.

Alert your firm to unsatisfactory collateral postings including:

- Insufficient collateral

- Ineligible collateral

- Wrong-way risk

- Concentration limit exceeded

Key Features

Transcend Collateral Validation is automated and independent, giving you the tools to mitigate potential counterparty risk

Take Control of Your Firm’s Exposure

Automatically ensure counterparties are posting adequate and sufficient collateral to improve governance

An effective counterparty risk management strategy should include a process to proactively validate whether collateral postings satisfy terms in order to comply with regulatory and audit requirements. While collateral pledgers have a host of solutions at their fingertips to allocate collateral, collateral receivers often lack the tools to test collateral adequacy and understand the reasons for exceptions.

Transcend’s Collateral Validation Service harmonizes collateral balances with eligibility schedules and reference data to automatically verify whether the collateral meets business and legal terms. The service also enables you to clearly understand and address the source of the validation breaks before they create financial risks for your firm or clients.

Learn More

Ready to Transform Your Risk Management Capabilities With Collateral Validation?

Eligibility Central

Eligibility Central

Seamlessly Expose More Options for Funding Decisions

Ensure You are Realizing the Greatest Funding Value From Your Assets

As the capital markets community increases focus on enterprise collateral management, optimization, and mobilization strategies, the need to harmonize collateral eligibility schedules is clear. However, with potentially thousands of counterparty agreements spread across CCP, triparty, derivatives, and bi-lateral systems, it is difficult to aggregate, normalize, and analyze all the needed data in a centralized location.

Transcend Eligibility Central is a unifying platform for collateral eligibility information and analytics. With eligibility information digitized and connected, firms can run never-before achieved analytics to drive smarter funding and trading decisions and accelerate critical collateral initiatives including optimization and straight-through-processing.

Explore the Solution

Do More With Your Financial Resources

Key Benefits

- Empower smarter trading decisions by identifying acceptable collateral types, with associated margins and constraints

- Reduce time and errors by eliminating the manual process of seeking and analyzing agreements, and connect them to the trades they govern

- Utilizing detailed agreements data at your fingertips, identify which clients are giving you the best terms, and reward them with the best trades

- Accelerate the time-to-value for various initiatives from collateral optimization to collateral mobilization and STP

Ready to More Seamlessly Analyze and Mobilize Collateral?

Buy-side Central

Buy Side Central

Achieve an End-to-End Margin and Collateral Workflow

Proactively and intelligently manage firm-wide assets

With new regulations causing investors to rethink how they better utilize their assets and an increasing need to holistically manage liquidity, asset managers, outsourcers and corporations are looking to more efficiently manage collateral and cash requirements. However, doing so requires a consolidated repository of asset inventory, optimization intelligence, and powerful liquidity analytics.

Transcend provides the buy-side with expert guidance and modular technology solutions to quickly address immediate needs and design a plan that drives long-term business transformation.

Transformational Benefits

- Optimize usage of collateral across all margining and finance needs

- Validate that collateral meets eligibility requirements in real-time

- Run intraday cash flow analytics with forecasting and projections

- Analyze portfolio for ESG and fund covenant requirements

- Track global collateral inventory across all custodians, funds, trading desks, and counterparties intraday

- Automate operations via connectivity to custodians, FCMs, triparty agents, and internal platforms

- Analyze portfolio for ESG and fund covenant requirements

Collateral Receivers Are Facing Increasing Collateral Management Challenges

With new regulations necessitating greater collateral efficiency but product silos making it difficult to achieve peak financial and operational performance, Transcend offers a much needed solution to achieve holistic portfolio analytics, optimization, and automation.

Learn More

A Full Suite of Solutions that Deliver an End-to-End Margin and Collateral Workflow

Transcend provides the institutional markets with best-in-class margin, inventory, and optimizations solutions

Ready to Elevate Your Collateral Management Capabilities?

CCP Central

CCP Central

Achieve End-to-End Cleared Margin Management

CCP Central connects, standardizes, optimizes, and automates CCP margin management.

Capture Cleared Margin in Your Optimization Strategy

Streamline margin and collateral decisions across your CCPs

For many firms, increased collateral requirements from CCPs due to heightened market uncertainty and volatility represents a daily challenge since cleared margin management requires coordination across front, middle and back-office functions. As margin obligations and collateral movements are often manually processed in product-specific operational silos and each CCP has its own interface, it is challenging to integrate diverse exposures into an enterprise-wide strategy.

CCP Central addresses these challenges by providing pre-built connectivity to CCPs, enabling a holistic and real-time view into obligations and balances that can be acted upon by key stakeholders, without the need for internal development resources to set up and maintain multiple complex CCP integrations.

Mitigate Margin Risk

Powerful rules & alerts framework

CCP Central enables users to define rules and alerts when specific criteria are met. A flexible validation engine empowers clients to customize rules and alerts to very specific, tailored needs.

Sample CCP Central Rules

- Deficit balance monitoring

- Excess balance monitoring

- Early notification of collateral maturity dates

- Notification of EOD/Intraday margin & collateral reports

CCP Central News & Resources

Ready to Elevate Your CCP Margin Strategy?

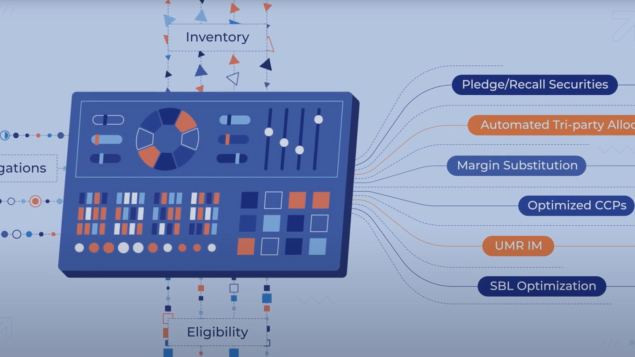

Inventory Optimization

Break Down Business Silos. Drive Profitability.

Transcend connects eligibility, supply, and demand data spread throughout internal and external systems to create a single source of truth. With a holistic scope, Transcend Optimization identifies truly optimal funding and liquidity decisions across products and businesses.

Imagine Adding Millions To Your Books Every Year

The opportunity cost is too great to miss out on holistic optimization

Transcend is helping clients save millions in financial and operational efficiencies annually. As pressures to improve performance increase, why limit your firm to optimizing one area or silo of the business? Transcend Inventory Optimization is helping clients achieve strategic goals faster than ever with the execution of smarter liquidity, funding, and collateral decisions.

Trust us, the benefits will speak for themselves.

Explore the Transformational Results of Inventory Optimization

- Improved Liquidity Management

- Maximized Operational Efficiency & STP

- Reduced Unsecured Funding Usage

- Best Allocation of Global Assets For Your Firm

- Expansive Scope With Configurable Scenarios Across Vertical and Horizontal Considerations

- Enhanced Scalability with Dynamic Response to Changing Business and Regulatory Conditions

Why Our Inventory Optimization is Superior

Transcend’s Inventory Optimization empowers clients to run cross-product optimization and manage bi-lateral finance trades, triparty activity and derivative margin flows from a single platform. The result is simple: better financial performance, greater liquidity, and streamlined operations.

With seamless integrations to your internal technology platforms and out-of-the-box connectivity to CCPs and Triparty agents, Transcend leverages the power of your existing systems and relationships to lift your entire business to a higher state of performance.

Learn More

Want to Know How Much You Could Save With Transcend Optimization?

Triparty Optimization

Triparty Collateral Management & Optimization

The Triparty Optimization Solution of Choice

With demonstrated successes for the world’s leading banks and broker-dealers, Transcend has solved even the most complex data, infrastructure, and implementation challenges in order to deliver transformational results.

With typical deployments completed in months, achieving best-in-class, scalable optimization is easier than you’d think.

Solution Highlights Include:

- Out-of-the-Box Connectivity to Triparty Agents

- Digitization of Legal Agreements and Collateral Schedule Terms

- Ability to Apply Dynamic Costs and Constraints to Multiple Optimization Scenarios

- Integrated Booking Service for Execution Automation and Straight-through-Processing

- Custom or Turn-key Optimization Algorithms

The Industry’s Most Sophisticated Triparty Optimization Engine

Transcend’s future-generation optimization technology delivers unmatched financial results

The Multi-Dimensional Optimization Differential

While most firms work with multiple triparty agents, many handle each relationship in a silo, limiting financial performance, efficiency, and control. Transcend’s Triparty Optimization technology automates allocation decisions in a way that puts millions back on your books every year.

Out-of-the-box connectivity harmonizes collateral obligations in real-time across multiple triparty agents. By defining scenarios to evaluate dynamic cost parameters and business / eligibility constraints against your entire asset inventory, Transcend’s Triparty Optimization solution identifies the most optimal collateral for each triparty shell in real-time.

Client Success Story

Ready to Run Smarter Triparty Optimization?

Collateral Optimization

Collateral Optimization That Evolves With You

Transcend’s Optimization Engine gives its clients the power to control parameters and rules to scale with changing business priorities.

Easily configure optimization scenarios and incorporate dynamic cost parameters to achieve efficiencies that best align with your organization’s goals.

Sample Collateral Optimization Rules

- Maximize LCR

- Minimize Collateral Haircuts

- Match Asset vs Liability Tenors

- Restrict Substitutions

- Facilitate Recalls

- Net Positions Across Legal entities and Depos

- Return Excess Borrow

- Sweep to Excess to Triparty

Transcend Delivers Transformational Results By:

Identify the most efficient ways to fund your business by assigning costs, constraints, and scenarios to your inventory and identifying optimal assets to finance.

Operationalize your optimization strategy and eliminate manual processes by automating the execution of single- or multi-step collateral movements and allocations.

Implement multiple costs and constraints that align with business-policies and goals and leverage cutting-edge algorithmic processing to identify actionable recommendations for superior financial performance.

Facilitate coordinated decision making with full transparency into inventory, obligations, and eligibility schedules across business and technology siloes.

Extract Maximal Value From Your Financial Resources

Capital Markets businesses are under increasing pressure from clients, shareholders, and regulators to more effectively manage their assets, liquidity, and funding costs. Transcend’s game-changing Collateral Optimization technology has empowered its clients to save millions every year by executing the smartest collateral allocations for a single business or across the enterprise.

Run cross-product optimization to manage bi-lateral finance, triparty, and derivative margin flows from a single platform to achieve superior performance results. Transcend can seamlessly integrate with each of its client’s existing technology ecosystem for an industry-leading implementation experience.