BJ Marcoullier, Global Head of Sales and Business Development at Transcend, reviews the platform’s evolution across the past decade and shares views on the future of the collateral market.

With Transcend celebrating its 10th anniversary in June, how has the firm evolved?

There are three key dimensions to our evolution. The first, and most important, is the people — we now have approximately 150 people globally, with offices in North America, UK and India, with a growing presence in Asia. In Europe, we recently added Emily Harris to further drive our local product development and focus on the securities finance space. It is highly important for us not only to have top-level talent, but also to have people that take pride in delivering a high-quality experience to our clients.

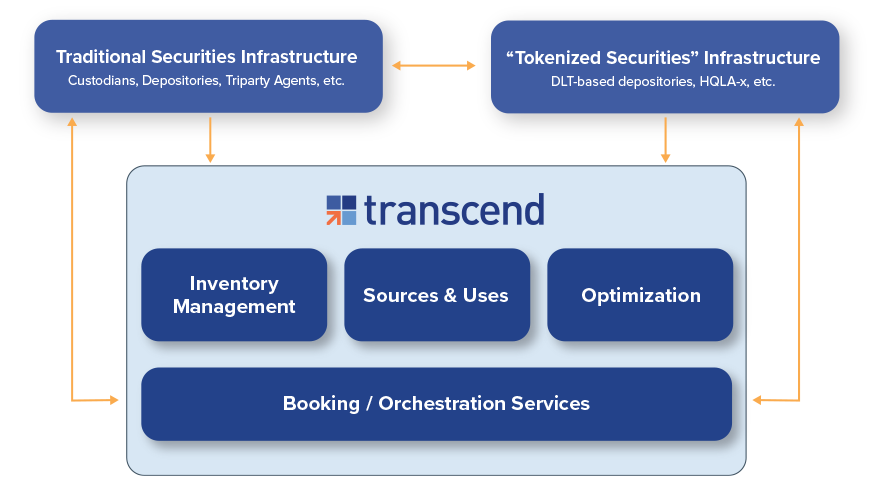

The second area of evolution is our clients. Five years ago, we were just extending our product to additional global banks. Now, we are onboarding clients globally across the sell-side — including banks and brokers — buy-side and custody space. As a result, we are now processing trillions of dollars of collateral each day. The last piece of our evolution has been on the product side. We moved from a modular product set to a highly scalable integrated solution offering, anchored around automating complex decision-making and collateral mobilization.

How are you aiding your clients in achieving their goals?

Quite simply, we are helping them to save tens of millions of dollars. Collateralized businesses — whether those are cleared or uncleared derivatives, equity or fixed income financing desks, triparty funding, or treasury areas — these all have a similar problem statement: how to bring together margin and collateral requirements, tagged inventory, collateral eligibility and business constraints in a harmonized fashion for scalable systematic decision making and execution.

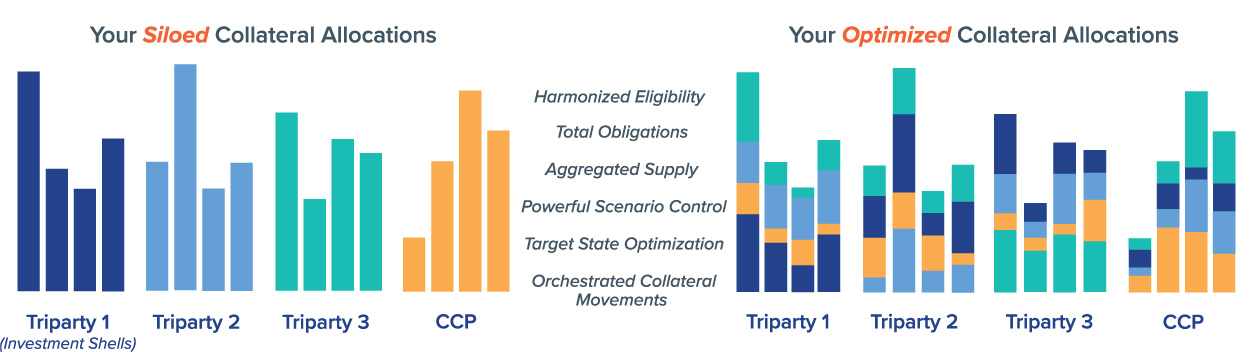

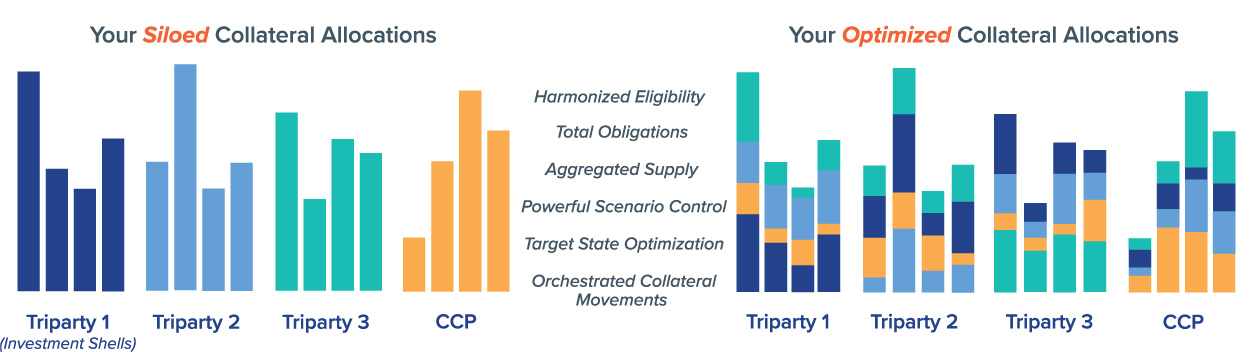

We help our clients construct the data and connectivity ecosystem they want to be able to best allocate their collateral at a target state. One example of this is our Cross Triparty Optimization offering, where we can recommend an optimal allocation across multiple triparty agents and orchestrate the necessary collateral movements to get the collateral, regardless of location, to the exact shell it needs to be in. The full scope of all of the various pieces of data necessary to make very comprehensive optimization decisions is only available if you join all of the clients’ internal and external data.

This holistic dataset does not exist with third parties such as triparty agents, central counterparties (CCPs), or in-margin systems. The art is to be able to scale this functionality to the specific scenarios that are important to each client. We can do this at a desk level or at an enterprise level. The results are amazing, and we hear about new use cases for our platform every day. From helping with liquidity coverage ratio (LCR), net stable funding ratio (NSFR), Comprehensive Capital Analysis and Review (CCAR) and Regulation YY, to unsecured funding, customer versus firm and cross-region, to name a few examples, the list keeps growing.

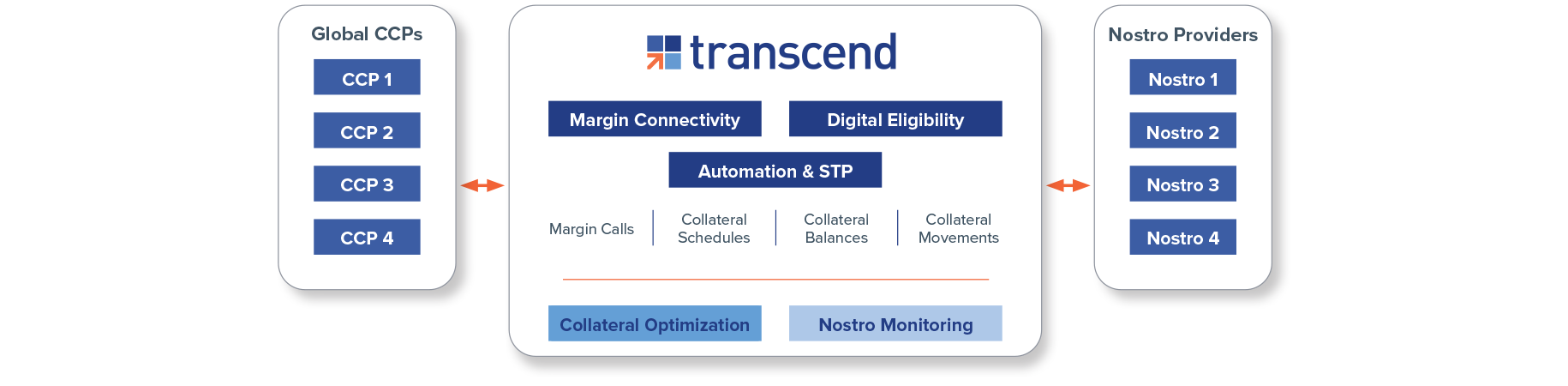

What challenges do market participants face with cross triparty and CCP optimization?

The first challenge is for businesses to understand the opportunity value and then effectively organize around extracting the benefits. Streamlining business flows across front, middle and back offices requires some adoption and new ways of thinking. Specifically, on the technology side, the main challenge is not the algos or the modeling. We are proud of our decision-making tool as it can incorporate a wide variety of linear and fixed cost constraints. However, the challenge is in connecting and normalizing the numerous ecosystems needed to facilitate delivery of the exact collateral allocation to the specified trade or shell level across agents.

Our experience in this effort is that it has not only been a win for our clients, but also for the agents, as well as streamlining collateral flows and bringing additional efficiencies to the entire collateral chain. From a high-level view, we have spent enormous resources connecting ecosystems across eligibility, inventory, optimization and booking frameworks to create a more interoperable ecosystem.

Figure 1: Cross Triparty Optimization maximizes every opportunity for the best collateral deployment.

Given recent market-related events and how they have impacted your clients, what products are sparking the most interest?

It is no secret that market volatility, higher interest rate regimes and risks that come from situations such as the debt ceiling stand-off put strain on the collateral management ecosystem. We are seeing this manifest in client interest in a few ways. One is the need to see detailed collateral and its liquidity value in real-time, not only on a projected basis but also what is sitting in depos from a centralized viewpoint. Therefore, when markets move, or when the regulator calls, participants have a clear picture of their inventory and exposures.

Given the market stress, we are also seeing demand for our Booking Service. When balance sheets are fluctuating, and collateral flows are very active, it is not sufficient to manage this with spreadsheets or manual uploads anymore. Operation teams need to scale and rely on systems that can seamlessly orchestrate high volumes of collateral in and out. Resiliency and scalability are becoming very high on the list of requirements for proper collateral optimization. Finally, higher rates have simply made the value case for optimization multiples greater than it was just a couple of years ago.

What benefits are you providing to clients through your platform?

As we noted, financial resource savings are typically the most visible benefit. This means reducing liquidity costs, funding costs and capital usage. Some firms estimate that there are hundreds of millions in savings on the table if they get enterprise collateral optimization done correctly. Most firms are in the early stages of this journey but, in practice, we have seen multiple millions saved by using our platform to optimize multiple binding constraints.

The other benefits are softer. We have seen our clients use our platforms to break down regional or desk-aligned silos. This means using Transcend for a common place to view inventory, eligibility, obligations, or for decision making. The final obvious benefit is that we are more precise and efficient than other allocation processes. We have proven that we can allocate with very high precision, exceeding a 99.8 per cent success rate. This means fewer top-ups, fewer collateral movements and lower substitution needs.

What are your market predictions for 2024?

I believe there will be a rapid acceleration of centralized collateral decision-making. The benefits are too large to wait and regulators are asking for this. Cobbling together spreadsheets or management information system (MIS) reports based on end-of-day (EOD) views is not going to be an acceptable standard. Our clients are looking for real-time holistic views.

Collateral optimization will become a broadly recognized front-office position, if not its own business unit. We also expect rapid growth in Europe and Asia. These markets have historically been increasingly bifurcated and complex operationally compared to North America. Technology is available to simplify working within or across these markets. Finally, buy-side firms, in particular asset managers, will seriously re-evaluate how they utilize outsourced services and what they should be paying for versus what they can do in-house.

There has always been a call across the industry for improved interoperability. From our perspective, the coordination and partnership happening across the sector has never been higher. Speaking for Transcend, all the triparty agents, CCPs, vendors and other industry players that we work with have been great partners on this journey for the benefit of our mutual clients.

As a result, our platform, and others like ours, are bringing optimization and interoperability closer to reality. This indicates that there are exciting times ahead for the securities finance industry.

Technology is finally enabling business transformations that have been discussed for a long time. My view is that this will lead to new trading opportunities, new sources of revenue and new ways to reduce a number of legacy risks. We are happy to be a part of this dynamic ecosystem and have a great set of people guiding it.

This article originally appeared in the ISLA Daily publication No.2, June 21, 2023, used with permission.