The Strategic Role of Collateral in Enterprise Optimization

For capital markets businesses, collateral is more than just an operations necessity — it is a core lever of balance sheet efficiency and liquidity management which, if handled effectively, creates a strategic advantage. As regulatory mandates continue to trend tighter and trading strategies evolve, the ability to deploy collateral intelligently across the enterprise is now a critical function.

Many financial institutions, however, continue to rely on outdated technology, manual processes, and business-siloed decision making. These legacy approaches limit collateral visibility and impede mobility, which means increased funding costs, aka lost P&L.

Collateral optimization addresses these challenges by aligning collateral usage with strategic objectives, whether to reduce funding costs, meet regulatory obligations more efficiently, or maximize asset utilization. Yet optimization is only as effective as the connectivity supporting it. Collateral connectivity — the seamless integration of data, systems, entities, and venues — enables real-time insights and action, ensuring the right assets are in the right place at the right time.

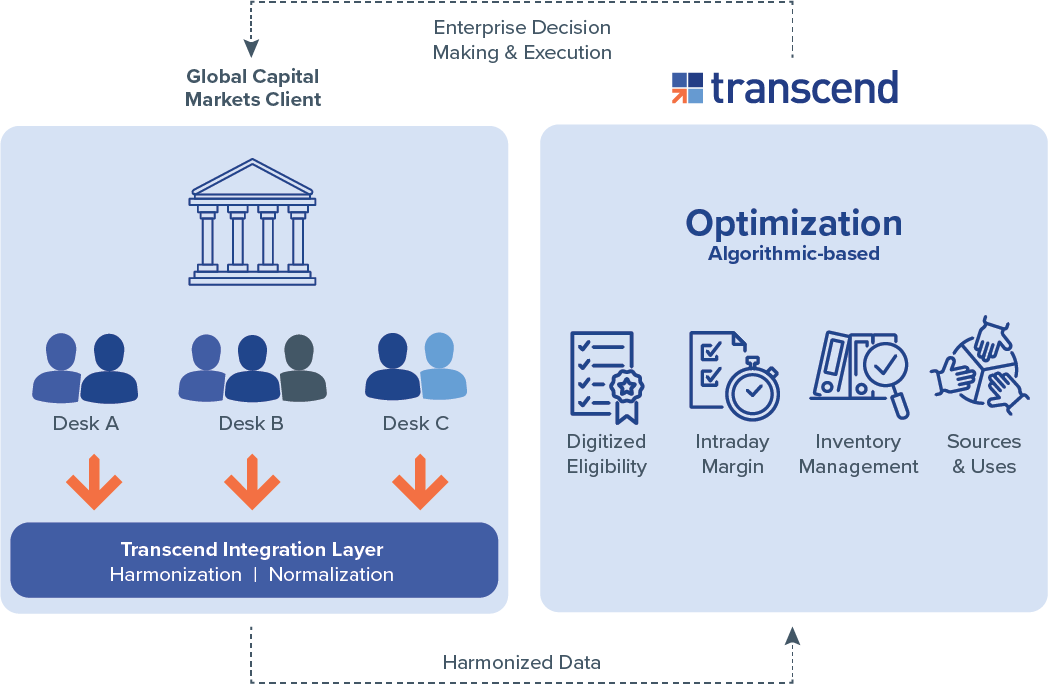

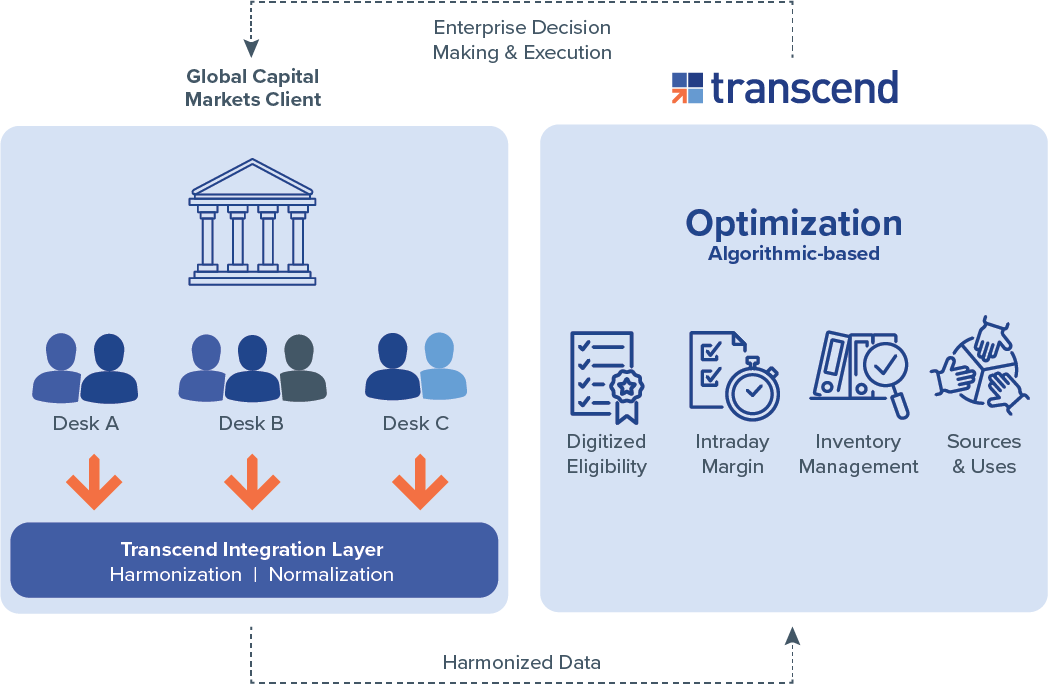

Transcend’s connected approach is unique in its ability to provide both collateral optimization and collateral connectivity. Together, the ability to connect to the global matrix of venues and optimize for configurable scenarios within and across them forms the most complete foundation for true enterprise collateral management.

The following case studies demonstrate how two global firms used Transcend to transform their collateral strategy and operations, achieving significant gains in funding efficiency, transparency, and risk control.

Case Study One: Enterprise Optimization Across Equities and Fixed Income Desks

The challenge:

A global bank faced a broad challenge — how to unlock realized collateral savings (net stable funding ratio (NSFR), liquidity coverage ratio (LCR), etc.), but at the enterprise level. This could be accomplished by optimizing collateral across both equities and fixed income desks, each with distinct requirements and previously siloed operations teams and infrastructure.

Key operational pain points included:

- Complex constraint environment. The firm needed to optimize across multiple dimensions, including asset quality, haircut, LCR, tenor, maturity, operational movements, and even customer or firm-driven attributes.

- Siloed infrastructure. Without integration between venues or business units, collateral mobility was limited, and optimization opportunities were missed.

- Manual eligibility checks. Lacking visibility into actual agent-level eligibility, internal teams moved collateral based on assumptions rather than analytics, resulting in poor asset placement success and unnecessary cost.

- Tagging and allocation limitations. The firm could not accurately tag or allocate assets at the shell level, making it difficult to fully utilize triparty optimization platforms.

- Record date risks. Assets were sometimes trapped in nonoptimal locations around record dates, reducing their usable liquidity and collateral value.

The solution and benefit

Transcend’s Cross Triparty Optimization solution provided the firm with a centralized and intelligent platform for enterprise-wide collateral decision making and execution:

- Full visibility across venues. With daily insights into eligibility, positions, trades, and usage across multiple-trip party agents, the firm could position assets optimally early in the day, ensuring maximum availability for end-of-day shell allocations.

- Defined optimization parameters. The platform allowed the firm to configure optimization rules to suit individual desk or cross-desk priorities — whether minimizing haircut, maximizing asset quality retention, preserving liquidity, reducing buffers, saving on movement costs, or just factoring unique counterparty of client attributes.

- Systemic execution. Optimization outputs were automatically fed into internal systems and to triparty venues, streamlining execution and improving accuracy.

- Shell-level precision. The firm gained the ability to dictate exact shell-level preferences, achieving targeted results for both operational efficiency and economic value.

- A single, connected platform. By consolidating visibility across business lines and venues, Transcend enabled the firm to break down internal silos and achieve holistic optimization — resulting in better funding decisions, reduced operational risk, and meaningful cost savings.

This transformation gave the firm true enterprise-wide control over collateral, unlocking a new level of agility and strategic alignment between business units, saving tens of millions in P&L and countless manhours.

Case Study Two: Optimization for Equities Desks Across the US and UK

The challenge:

Another global bank wanted to optimize collateral across regionally siloed equities finance desks but faced multiple structural and operational hurdles, such as:

- Manual allocation practices. Collateral selection and substitution were largely manual, due to siloed operations teams creating inefficiencies and limiting flexibility.

- Lack of automation and mobility. Without automation and cross-region asset mobility, the firm was unable to react dynamically to funding needs and market conditions.

- Collateral recall challenges. Counterparty re-use of pledged collateral made it difficult to recall and redeploy assets efficiently.

- Inadequate agreement data. Internal systems lacked digitized eligibility data, making it hard to validate decisions and optimize allocations.

- No cross-triparty optimization. The firm could not coordinate movements across triparty venues or manage shell-level preferences or effectively differentiate between firm and client priorities.

- Missing scenario analysis. The team was unable to run hypothetical ‘what-if’ simulations to inform strategic decisions or forecast the impact of proposed asset movements.

Transcend solution and benefit

By implementing Transcend’s optimization platform, the firm was able to automate and elevate its collateral operations across the US and UK:

- Shell-level automation. Optimal collateral allocation decisions were automated and tailored to shell-level requirements for multiple venues, reflecting asset quality, haircut, and client versus-firm usage constraints.

- STP booking to triparty agents. Using Transcend’s straight through processing (STP) booking services, the firm automated collateral movements directly into multiple triparty venues, dramatically reducing operational overhead and effectively broadening the pool of available collateral.

- Enhanced inventory visibility. Real-time insights into collateral inventory and movements enabled proactive decision-making and efficient asset sourcing, as well as facilitating better trading decisions.

- Hypothetical scenarios. Teams could now model what-if scenarios, such as acquiring new client assets or adjusting the funding mix, helping determine the most cost-effective strategies while preserving high-quality liquid assets.

- Measurable impact. The optimization efforts revealed an opportunity to increase funding capacity by US$500 million in less-liquid assets, improving overall balance sheet usage.

This marked a transformative shift, with equities finance teams now equipped with both the tools and the data needed to make smarter, faster collateral decisions at a coordinated global level.

The Value of Collateral Connectivity

Collateral connectivity refers to the seamless, real-time orchestration of data, systems, entities, and movements across the entire collateral ecosystem.

These case studies underscore a central truth — collateral optimization is only as powerful as the connectivity that supports it.

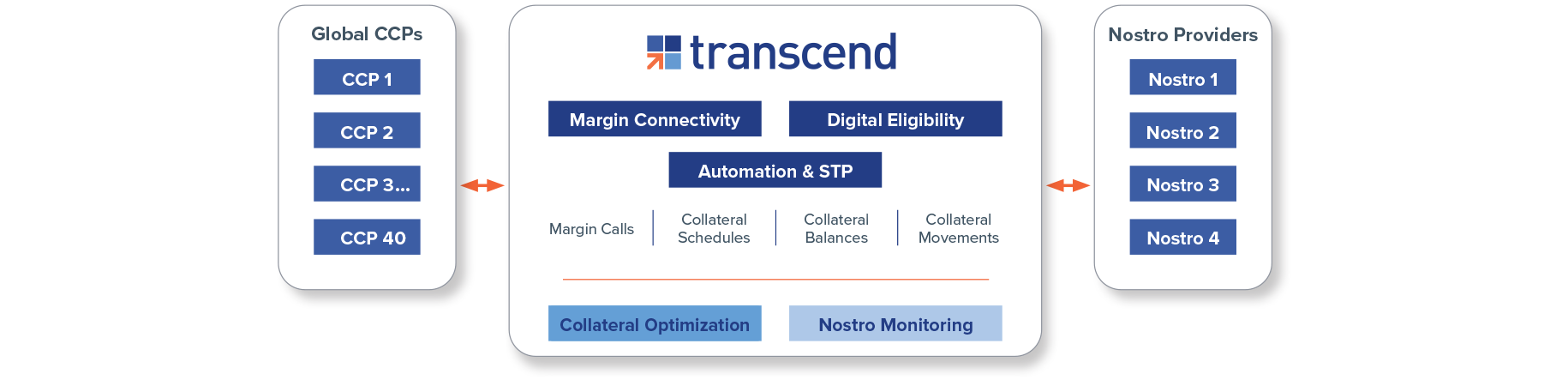

That is the strength of Transcend. We unlock the power of a connected ecosystem through off-the-shelf, seamless data and operational integration with all major global triparty agents, internal systems, most major vendor platforms, more than 40 custodians, over 45 central counterparties, SWIFT, Fedwire, CSDs, and other major market infrastructure.

This connectivity has taken us more than a decade to build, but without it, we would not be able to achieve the benefits our clients are looking for. These include:

- Real-time visibility into detail-rich assets and obligations, along with comprehensive eligibility terms and constraints.

- Enterprise optimization: Intelligent analytics that enable cross-entity, cross-venue optimization aligned with firm-specific constraints and objectives.

- Automation at scale: STP capabilities to automate collateral allocations and substitution workflows, reducing operational load and settlement risk.

- Real-time insights: Dashboards and analytical tools to provide a 360-degree view of inventory, usage, and opportunity.

- Strategic scenario analysis: What-if modelling to evaluate new funding strategies, asset sourcing decisions, and balance sheet impacts.

- Accurate tagging of data and booking orchestration: Reducing reconciliation errors and improving allocation precision.

- Coordinated movements across silos: Breaking down the traditional barriers between desks, regions, and business functions.

- Proactive response to change with configurable scenario creation, whether driven by markets, regulations, or liquidity events. Without robust connectivity, optimization remains solely a theoretical exercise. With it, optimization becomes a driver of real business value.

Enabling smarter allocation decisions or transforming legacy processes, Transcend equips its clients with the tools, insights, and infrastructure to achieve their strategic goals.

Originally published in the Securities Finance Times, issues 379, June 10, 2025.